What happens if US gets too much debt?

In particular, if interest payments on the national debt couldn't be paid, there could be a default on federal debt securities. If a default occurred, the stellar financial reputation of the United States government would be severely tarnished, and interest rates would rise.

Rising debt means fewer economic opportunities for Americans. Rising debt reduces business investment and slows economic growth. It also increases expectations of higher rates of inflation and erosion of confidence in the U.S. dollar.

Decreased savings and income

The private sector will stop seeking investments that can generate growth due to the incentive to save. This includes the lower amount of capital available once individuals stop investing in securities offered by businesses due to treasury securities being more attractive.

As we have discussed elsewhere, government debt reduces economic activity by crowding out private capital formation and by requiring future tax increases or spending cuts to accommodate future interest payments.

Your Credit Score Has Declined

If you are using too much of your available credit, or are late on payments, your credit score will decline. A lower credit score will make it harder to borrow or consolidate debt at a lower interest rate, and thus harder to pay off the debt that you have accumulated.

The national debt enables the federal government to pay for important programs and services even if it does not have funds immediately available, often due to a decrease in revenue. Decreases in federal revenue coupled with increased government spending further increases the deficit.

- Japan. Japan has the highest percentage of national debt in the world at 259.43% of its annual GDP. ...

- United States. ...

- China. ...

- Russia.

Economists at the Penn Wharton Budget Model estimate that financial markets cannot sustain more than twenty additional years of deficits. At that point, they argue, no amount of tax increases or spending cuts would suffice to avert a devastating default.

The public owes 74 percent of the current federal debt. Intragovernmental debt accounts for 26 percent or $5.9 trillion. The public includes foreign investors and foreign governments. These two groups account for 30 percent of the debt.

| Characteristic | National debt in relation to GDP |

|---|---|

| Macao SAR | 0% |

| Brunei Darussalam | 2.06% |

| Kuwait | 3.08% |

| Hong Kong SAR | 4.27% |

How much does the US owe China?

China is one of the United States's largest creditors, owning about $859.4 billion in U.S. debt. 1 However, it does not own the most U.S. debt of any foreign country.

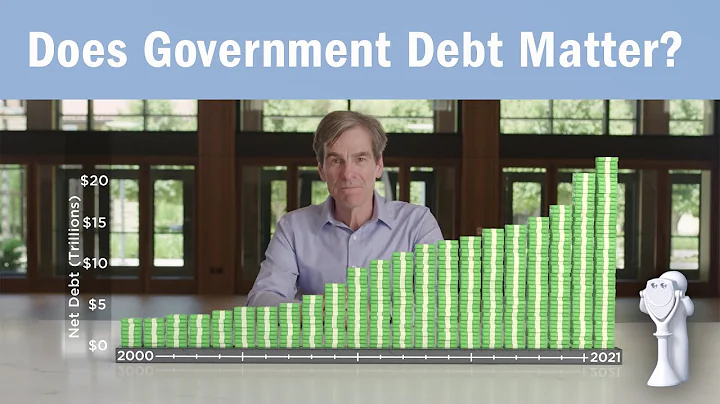

It began rising at a fast rate in the 1980's and was accelerated through events like the Iraq Wars and the 2008 Great Recession. Most recently, the debt made another big jump thanks to the pandemic with the federal government spending significantly more than it took in to keep the country running.

Economists measure the severity of a nation's debt based on its debt-to-GDP ratio. The U.S. debt held by the public is nearly at 100%. The Committee for Economic Develop of the Conference Board says a responsible debt-to-GDP ratio for a country the size of the U.S. would be 70%.

Around 70% of Japanese government bonds are purchased by the Bank of Japan, and much of the remainder is purchased by Japanese banks and trust funds, which largely insulates the prices and yields of such bonds from the effects of the global bond market and reduces their sensitivity to credit rating changes.

An Explainer. Just about every country has debt: governments take loans to pay for new roads and hospitals, to keep economies ticking over when recessions hit or tax revenues fall. Sometimes they borrow from countries, other times banks, or maybe asset managers—companies like those investing your pension dollars.

Federal Borrowing

The federal government borrows money from the public by issuing securities—bills, notes, and bonds—through the Treasury. Treasury securities are attractive to investors because they are: Backed by the full faith and credit of the United States government.

The United States of America. The United States upholds its status as the major global economy and richest country, steadfastly preserving its pinnacle position from 1960 to 2023. Its economy boasts remarkable diversity, propelled by important sectors, including services, manufacturing, finance, and technology.

Answer and Explanation: If the U.S. was to pay off their debt ultimately, there is not much that would happen. Paying off the debt implies that the government will now focus on using the revenue collected primarily from taxes to fund its activities.

The major international owners of US debt include Japan ($1.1T), China, UK, Belgium, Switzerland, Cayman Islands and smaller amounts from the rest of the world. After the recent weak treasury auction, US government officials warned that they are seeing waning demand from international buyers.

- Brunei. 3.2%

- Afghanistan. 7.8%

- Kuwait. 11.5%

- Democratic Republic of Congo. 15.2%

- Eswatini. 15.5%

- Palestine. 16.4%

- Russia. 17.8%

Which 5 countries own the most U.S. debt?

- Japan. Japan held $1.15 trillion in Treasury securities as of January 2024, beating out China as the largest foreign holder of U.S. debt. ...

- China. China gets a lot of attention for holding a big chunk of the U.S. government's debt. ...

- The United Kingdom. ...

- Luxembourg. ...

- Canada.

| Country/territory | US foreign-owned debt (January 2023) |

|---|---|

| Japan | $1,104,400,000,000 |

| China | $859,400,000,000 |

| United Kingdom | $668,300,000,000 |

| Belgium | $331,100,000,000 |

The financial position of the United States includes assets of at least $269 trillion (1576% of GDP) and debts of $145.8 trillion (852% of GDP) to produce a net worth of at least $123.8 trillion (723% of GDP).

Of course, some consequences we do know, like the amount of interest we pay on that debt: about $2 billion a day, and by 2050, the Congressional Budget Office projects the interest payments on our debt will be the country's single biggest expense.

Why Is the U.S. Debt So High? Essentially, because the government repeatedly spends more money than it receives in tax revenue. Many point to tax cuts passed by Congress as the major culprit for decreasing this income. Others point to out-of-control, politically-driven spending as the reason.

References

- https://www.investopedia.com/ask/answers/042015/how-does-money-supply-affect-inflation.asp

- https://www.incharge.org/debt-relief/how-much-debt-is-too-much/

- https://www.nfcc.org/blog/how-to-get-out-of-credit-card-debt-without-paying-everything-you-owe/

- https://www.helpwithmybank.gov/help-topics/debt-credit-scores/debt-management/garnishments/garnishment-exempt-funds.html

- https://www.forbesindia.com/article/explainers/top-10-largest-economies-in-the-world/86159/1

- https://baylegal.org/what-we-do/stability/consumer-protections/fact-sheet-credit-card-debt-english/

- https://www.itsuptous.org/blog/consequences-of-national-debt

- https://www.bankrate.com/personal-finance/debt/get-out-of-debt-on-low-income/

- https://www.gao.gov/americas-fiscal-future/federal-debt

- https://www.cfr.org/backgrounder/us-national-debt-dilemma

- https://www.bu.edu/articles/2023/what-is-the-sovereign-debt-crisis-and-can-we-solve-it/

- https://www.stlouisfed.org/annual-report/2009/the-power-of-money

- https://www.debt.org/retirement/social-security/can-social-security-be-garnished-for-credit-card-debt/

- https://www.consumerfinance.gov/ask-cfpb/what-should-i-do-if-im-sued-by-a-debt-collector-or-creditor-en-334/

- https://homework.study.com/explanation/what-would-happen-if-the-u-s-actually-paid-off-the-national-debt-where-would-the-banks-big-financial-institutions-and-government-foreign-and-domestic-put-their-cash.html

- https://www.creditkarma.com/insights/i/average-debt-by-age

- https://www.cbsnews.com/news/who-qualifies-for-credit-card-debt-forgiveness/

- https://www.solosuit.com/posts/guide-elderly-debt-collection-laws

- https://www.businessinsider.com/personal-finance/what-causes-inflation

- https://www.bankrate.com/personal-finance/credit/when-does-old-debt-fall-off-credit-report/

- https://www.cnbc.com/2011/02/14/The-Worst-Hyperinflation-Situations-of-All-Time.html

- https://worldpopulationreview.com/country-rankings/countries-by-national-debt

- https://bals.org/help/resources/can-creditor-take-my-home-if-i-do-not-pay-debt

- https://medium.datadriveninvestor.com/will-the-us-government-ever-stop-printing-money-21b3fddf466d

- https://www.consumerfinance.gov/ask-cfpb/does-a-persons-debt-go-away-when-they-die-en-1463/

- https://en.wikipedia.org/wiki/Financial_position_of_the_United_States

- https://www.investopedia.com/articles/markets-economy/090616/5-countries-own-most-us-debt.asp

- https://www.statista.com/statistics/273488/countries-with-the-lowest-national-debt/

- https://obryanlawoffices.com/bankruptcy-help/there-is-no-jail-time-for-unpaid-credit-card-debt/

- https://www.investopedia.com/articles/personal-finance/121614/5-things-debt-collectors-are-forbidden-do.asp

- https://www.farmermorris.com/faqs/11-word-phrase-to-stop-debt-collectors/

- https://www.pgpf.org/top-10-reasons-why-the-national-debt-matters

- https://www.investopedia.com/financial-edge/0611/june-20-5-ways-the-u.s.-can-get-out-of-debt.aspx

- https://www.itsuptous.org/blog/who-does-us-owe-money-to

- https://www.vedantu.com/commerce/debt-free-countries

- https://www.linkedin.com/pulse/who-going-buy-all-us-debt-rod-khleif-gdete

- https://www.forbes.com/advisor/retirement/debt-ceiling-impact-social-security/

- https://www.marketplace.org/2024/01/30/us-national-debt-34-trillion/

- https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/

- https://www.bankrate.com/personal-finance/debt/can-creditors-take-social-security/

- https://www.quora.com/How-much-money-has-been-printed-USD-and-what-percentage-of-that-is-still-available

- https://www.justia.com/criminal/offenses/white-collar-crimes/money-counterfeiting/

- https://www.cnbc.com/2023/09/10/why-the-national-debt-can-both-help-and-hurt-the-us-economy.html

- https://www.cbsnews.com/minnesota/news/good-question-how-did-the-u-s-debt-get-so-high/

- https://helpsishere.org/prepaidcard.html

- https://apacentrepreneur.com/why-cant-nations-around-the-globe-print-money-to-get-rich/

- https://www.quora.com/What-would-happen-if-the-U-S-actually-paid-off-the-national-debt-Where-would-the-banks-big-financial-institutions-and-government-foreign-and-domestic-put-their-cash

- https://usafacts.org/articles/which-countries-own-the-most-us-debt/

- https://www.consumerfinance.gov/ask-cfpb/can-debt-collectors-collect-a-debt-thats-several-years-old-en-1423/

- https://www.incharge.org/debt-relief/credit-counseling/bad-credit/collection-laws-for-seniors/

- https://www.tbsnews.net/features/panorama/us-keeps-printing-money-why-cant-we-539758

- https://www.sacbee.com/finance/article273779500.html

- https://www.seniorliving.org/research/getting-out-of-debt/

- https://en.wikipedia.org/wiki/National_debt_of_Japan

- https://www.investopedia.com/articles/insights/122016/9-common-effects-inflation.asp

- https://www.freefacts.org/social-security/why-cant-we-just-print-more-money

- https://www.investopedia.com/ask/answers/082515/who-decides-when-print-money-us.asp

- https://theconversation.com/why-we-cant-just-stop-printing-money-to-get-inflation-down-180016

- https://www.credit.com/blog/does-your-old-debt-have-an-expiration-date/

- https://www.nerdwallet.com/article/finance/what-happens-if-us-defaults

- https://www.treasurydirect.gov/government/historical-debt-outstanding/

- https://www.investopedia.com/articles/investing/080615/china-owns-us-debt-how-much.asp

- https://assistinghands.com/55/florida/sarasota/blog/seniors-with-no-money/

- https://budgetmodel.wharton.upenn.edu/issues/2023/10/6/when-does-federal-debt-reach-unsustainable-levels

- https://www.bankrate.com/finance/credit-cards/can-you-go-to-jail-for-credit-card-debt/